Key Factors to Consider if You Break a Lease

Key Factors to Consider if You Break a Lease

Blog Article

The hire market is always moving, with an increase of renters than ever rethinking their residing situations. Searches about “what happens if you break a lease” soared by around 70 per cent within the last year alone, sending an obvious trend. Whether it's a work modify, unexpected economic difficulties, or a relationship shift, your decision to break a lease is not anyone to take lightly. Knowledge the key facets at play can save you from unexpected financial and legal headaches.

Early Terminations on the Rise

A current analysis across significant US cities exposed that approximately 18 percent of tenants consider breaking their lease before the total expression ends. That mirrors broader improvements in employment, lifestyle, and actually mental health priorities. Knowledge also shows that young renters, particularly those aged 18 to 34, are probably the most probably to produce a shift mid-lease. If you're in that group, you're certainly not alone.

Financial Penalties Top the Number

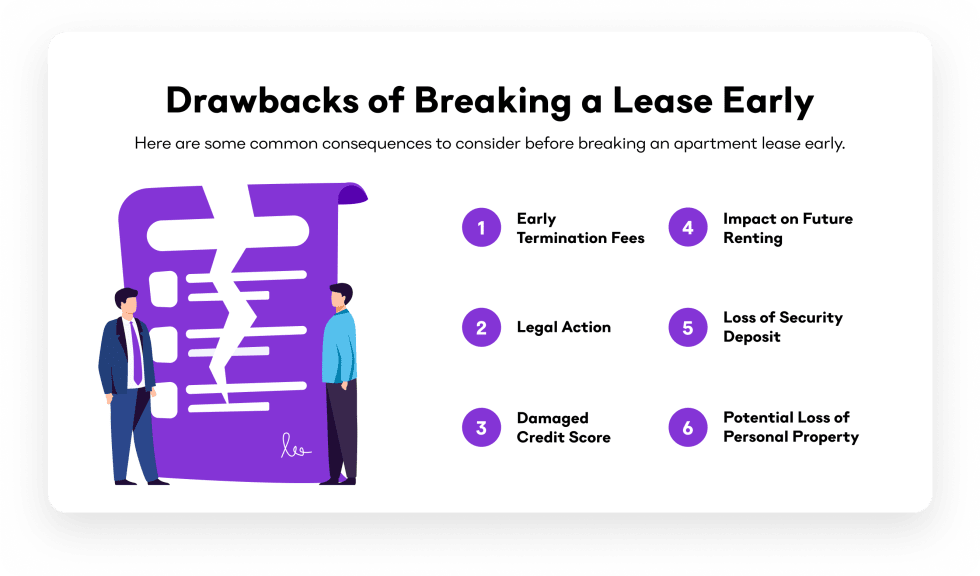

The most immediate issue visitors have could be the financial impact. Study benefits suggest that 65 percent of landlords charge some form of early termination charge, which can range from the cost of an individual month's rent to the total lease remaining on your own agreement. About 28 percent of visitors interviewed said they underestimated these fees, ultimately causing shock expenses that set back their budgets.

Concealed Expenses and Other Costs

It's not merely about termination fees. Some landlords also withhold safety deposits or cost for re-listing the property. Typically, renters can eliminate an additional 20 % of these deposit if the apartment requires washing or fixes after an early on exit. Understanding these figures can assistance with choice making before offering notice.

Appropriate and Credit Consequences

Breaking a lease can follow you in more methods than one. Nearly 22 per cent of tenants who broke their leases without talking reported a indent for their credit report. Landlords may send your unpaid amounts to selections, making it tougher to rent elsewhere or secure loans. Additionally, being sued for unpaid book is really a real, if less common, risk.

Adequate Factors and Negotiations

Not all lease pauses are treated equally. The absolute most frequently acknowledged factors contain health and safety violations, military deployment, or significant home injury from events like natural disasters. More than half of tenants polled effectively negotiated with their landlords for a lowered price or simpler terms once they provided certification for such reasons.

The Conversation Element

Information shows that visitors who communicated early and overtly with their landlords could actually save typically 35 percent on penalty costs. Setting objectives, sharing documentation, and arranging for a replacement tenant may all help reduce the fallout. The sooner you begin the conversation, the greater your possibilities to decrease expenses and protect your credit score.

What the Tendencies Inform People

Lease-breaking is actually trending upward. Yet, the risk of unexpected fees and legal difficulty stays large for those who do not strategy ahead. Reviewing your lease contract, understanding the fine printing, and seeking legal counsel if required are smart first steps.

Examining lease-breaking statistics may give tenants a better picture of what's at stake, which makes it better to weigh their alternatives and avoid economic missteps. Being prepared and hands-on converts what is actually a key setback right into a well-managed transition. Report this page